Tax News September 2024

Tax News September 2024

Welcome to Tax News

Subscribe to get monthly updates on tax laws, policies, and events.

Welcome to Tax News

Subscribe to get monthly updates on tax laws, policies, and events.

Overview

Tax News is a monthly online publication to inform tax professionals, taxpayers, and business owners about state income tax laws; Franchise Tax Board (FTB) regulations, policies, and procedures; and events that may impact or provide valuable information for the tax professional community.

We also periodically release Tax News Flashes to quickly notify subscribers of urgent time-sensitive information.

In this edition September 2024

- Form 4197 – Required Reporting for Certain Deductions, Credits, Exclusions, and Exemptions

- San Diego County Disaster Notice Assistance

- FTB 5818, Notice of Tax Return Change

- FTB Contact Centers

- Adjusted Interest Rates

- How-to Video for Power of Attorney (POA) and Tax Information Authorization (TIA)

- Internal Revenue Service (IRS) Updates and More

- Ask the Advocate

Form 4197 – Required Reporting for Certain Deductions, Credits, Exclusions, and Exemptions

As October approaches, we want to remind you of the reporting requirements for clients who take certain deductions, credits, exclusions, and exemptions. If you have clients with any of the following reported on their tax return, be prepared to fill out Form 4197:

- Thomas and Woolsey Wildfires Exclusion (TWWE)

- Turf Replacement Water Conservation Program Exclusion (TRWCP)

- Emergency Financial Aid Grants (EFAG)

- ARPA Student Loans Forgiveness (ARPSLF)

- Kincade Wildfire Exclusion (KWE)

- Zogg Wildfire (ZWE)

- Paycheck Protection Program (PPP)

- Other Loan Forgiveness (OLF)

- Economic Injury Disaster Loan (EIDL)

- Restaurant Revitalization Grant (RRG)

- Shuttered Venue Operator Grant (SVOG)

- Deployed Military Exemption (DME)

- Commercial Cannabis Activity (CBIS)

The legislature specifies the metrics used to evaluate the programs and occasionally requires metrics currently not reported on the state tax return. As a result, FTB uses form 4197 to capture the information necessary to report these metrics in legislatively mandated reports.

Taxpayers must submit Form 4197 in addition to any other credit forms or expense schedules that are required to be filed with their tax return. If your tax software does not support Form 4197, mail the form. This correspondence address link will direct you to the correct address for both businesses and individuals.

For more information and instructions, review Form 4197 and Form 4197 Instructions.

View previously released data, reports, and plans.

San Diego County Disaster Notice Assistance

San Diego County individuals and businesses impacted by the severe storms and flooding that began on January 21, 2024, qualified for a postponement to file and pay 2023 taxes until June 17, 2024. San Diego County taxpayers who did not mark "disaster" on their return may have received penalty notices. Taxpayers may have also received notices due to timing of peak season notices and posting of payments.

If San Diego County taxpayers received a penalty notice for the 2023 taxable year related to the disaster postponement, taxpayers or tax professionals can do one of the following for resolution:

- Check MyFTB for up-to-date account information.

- **NEW** Submit an email to FTBSanDiegoDisasterRelief@ftb.ca.gov. This email was designed exclusively for San Diego County taxpayers who received notices related to the disaster postponement. The following information is required to process the disaster relief request:

- Taxpayer name

- Address during the disaster (must be principal residence or principal place of business)

- Email address

- Telephone number

- 10-digit FTB identification number or 15-digit notice number

Do not include social security numbers or any other confidential information. Allow up to 8 weeks for the request to process. Once the request is processed, taxpayers will receive a confirmation letter from FTB via the U.S. Postal Service. Only emails related to San Diego County disaster will be processed through this mailbox.

FTB 5818, Notice of Tax Return Change

Reason for notice

When errors are identified on a return during processing, an FTB 5818, Notice of Tax Return Change (NTRC) is sent to the taxpayer. The adjustments may increase, reduce, or disallow an overpayment or create an additional balance due on the account. The tax return change information is only for the tax year printed at the top of the notice.

Paragraph code

Each tax return change includes one or more paragraph codes thatn corresponds to an explanation of the adjustment made on the return. The codes are printed with the explanatory paragraph on the notice. You can search for the explanations of paragraph codes and get information on what to do next at notice of tax return change. You can also locate the page by searching for "NTRC" on our website.

Gathering documents

Gather and review all relevant tax documents to check for errors. For withholding verification, supporting documents can be from a W-2, W-2G, W-2C, 1099-Misc, 1099-R, 592-B, 593, or K-1. To save time, supporting documents can be uploaded to a MyFTB account for resolution.

Penalties and interest

When a NTRC results in an additional balance due, the taxpayer has 15 days from the date on the notice to pay without incurring penalties and interest.

FTB Contact Centers

We know your time is valuable. To ensure you and your client needs are met, be sure to use the most appropriate contact center.

If you are calling for assistance with an FTB notice or letter you received, call the phone number provided on the notice or letter. Calling the correct contact center assists to ensure your issue or inquiry is addressed more quickly by the most appropriate FTB staff.

This can also prevent delays caused by unnecessary transfers.

Adjusted Interest Rates

For the period January 1, 2025, through June 30, 2025, the interest rate is 8%. This is the rate compounded daily that accrues with respect to various state taxes, to include:

- Personal income

- Corporate income

- Franchise income

The rate for corporation tax overpayments for the same period is 5%.

For more information, go to interest and estimate penalty rates.

How-to Video for Power of Attorney (POA) and Tax Information Authorization (TIA)

We are excited to announce the most recent how-to video aimed to help your client add a POA relationship quickly and easily with their mobile device. This process does not require a form or signature, and only takes a few minutes.

The video for How to Submit a Power of Attorney (POA) on a Mobile Device is available now!

FTB will continue to release new how-to videos to help you submit and manage your POAs and TIAs. Current videos can be found on FTB’s YouTube page and on FTB’s public website within the Help with POA page.

Internal Revenue Service (IRS) Updates and More

We partnered with the IRS to provide monthly IRS articles to assist our tax professional and small business communities. We are excited to share this information; however, if you have questions about the content, you will need to contact the IRS directly.

IR-2024-213, Aug. 15, 2024 — The IRS urged businesses that have received Employee Retention Credit payments to recheck eligibility requirements and consider the second Employee Retention Credit (ERC) Voluntary Disclosure Program (VDP) to resolve incorrect claims without penalties or interest.

IR-2024-212, Aug. 15, 2024 —The IRS announced a limited time reopening of the Voluntary Disclosure Program to help businesses fix incorrect Employee Retention Credit claims as the agency continues compliance work.

IRS accepting applicants for 2025 Compliance Assurance Process with expanded eligibility criteria

IR-2024-211, Aug. 15, 2024 — The IRS announced the opening of the application period for the 2025 Compliance Assurance Process (CAP) program, which will run from Sept. 4 to Oct. 31, 2024.

IR-2024-210, Aug. 14, 2024 — The IRS strongly urges qualifying businesses, tax-exempt organizations, and state, local and Indian tribal governments to complete the pre-filing registration process now for projects placed in service in 2023 if they plan to claim elective pay.

IR-2024-208, Aug. 13, 2024 — The IRS and the Security Summit partners announced the availability of a new, updated Written Information Security Plan designed to help protect tax professionals against continuing threats from identity thieves and data breaches.

IR-2024-206, Aug. 12, 2024 — The IRS reminded taxpayers of the ability to submit electronic requests for relief for certain late-filed international documents.

IR-2024-203, Aug. 8, 2024 — The IRS announced additional actions to help small businesses and prevent improper payments in the Employee Retention Credit (ERC) program, including accelerating more payments and continuing compliance work on the complex pandemic-era credit that was flooded with claims following misleading marketing.

Department of Treasury and IRS release Inflation Reduction Act clean energy statistics

IR-2024-202, Aug. 7, 2024 — The Department of the Treasury and the IRS issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023.

Multi-factor authentication: Key protection to tax professionals' security arsenal now required

IR-2024-201, Aug. 6, 2024 — The IRS and the Security Summit partners remind tax professionals that using multi-factor authentication is now more than an important protection for their businesses and their clients - it’s now a federal requirement.

Ask the Advocate: Systemic Issue Management System (SIMS) Follow-up

Angela Jones, Taxpayers’ Rights Advocate

Thank you for your continued efforts to bring potential systemic issues to my attention. This month I will provide a follow up to my July 2023 Ask the Advocate Article. Our collaborative relationship facilitated change to FTB processes.

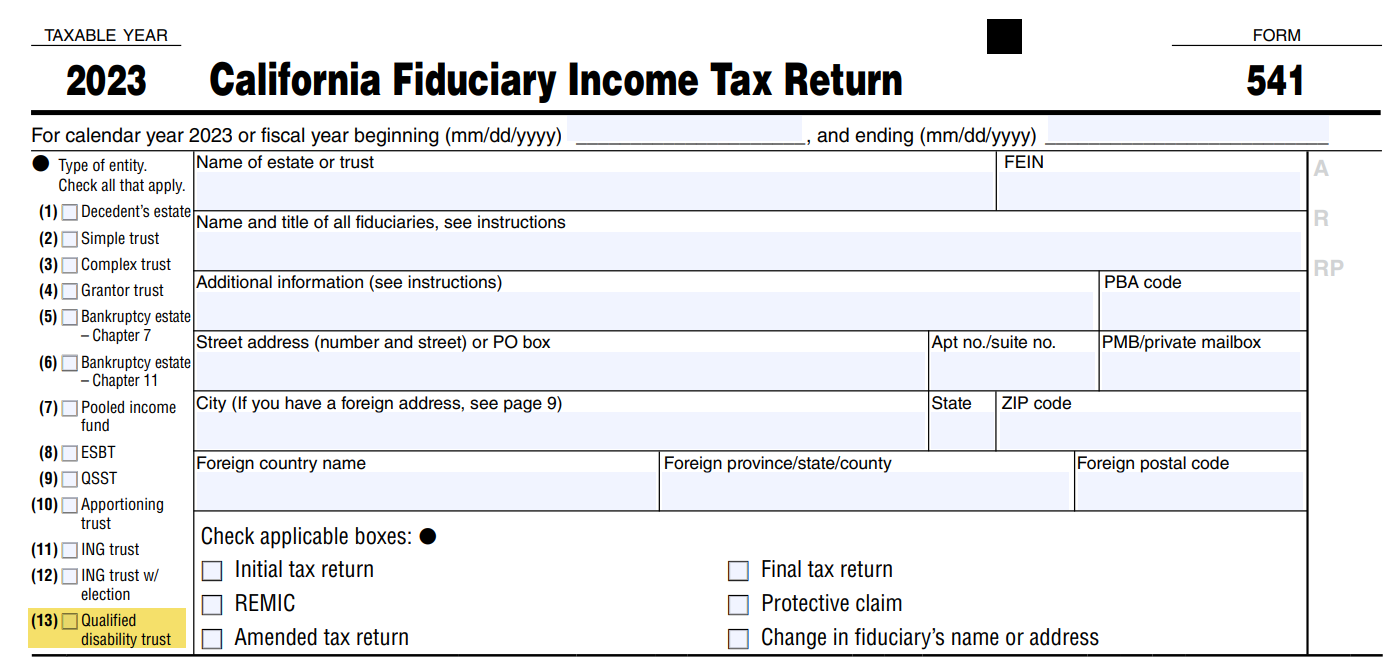

About a year ago, a tax practitioner reported an inconsistency with Form 541 California Fiduciary Income Return processing for Special Needs Trusts, also known as Qualified Disability Trusts. The practitioner reported his 2022 Special Needs Trust clients received unnecessary and inaccurate notices. My team collaborated with FTB business areas to research the issue, and discovered the practitioner's tax software provider was incorrectly populating the previous year's exemption amount. Additionally, FTB’s Form 541 did not include a Qualified Disability Trust check box like the IRS Form 1041 that includes this check box. The incorrect exemption amount resulted in inaccurate processing and unnecessary notices.

In collaboration with FTB Forms team, Form 541 was revised to include a Qualified Disability Trust check box to mirror the IRS Form 1041. This is a new check box on the 2023 FTB Form 541 that was not on the 2022 FTB Form 541. Previously, the procedure was to use the "Complex Trust" box. This process is still in effect for taxable years prior to 2023.

Beginning with taxable year 2023, you will use the Qualified Disability Trust check box on the Form 541 entity section for your Special Needs Trust clients. Follow the Form 541 instructions for the remainder of the form.

The revisions to Form 541 illustrates the benefits of the Systemic Issues Management System (SIMS). When you report in SIMS, my team will evaluate to determine the impact to taxpayers. If your submission is systemic, we will work with the appropriate business area to resolve. We recently updated the SIMS submission form on our website. The submission form now requires more identifying information. This will allow us to research more efficiently to resolve issues. The SIMS update optimizes the process and enhances communication between taxpayers, tax professionals, and FTB.

Please continue to submit potential systemic issues that affect your clients. Doing so facilitates improved tax administration and enhances the services to California taxpayers. Thank you as I sincerely appreciate your support.